Canada Cannabis Spot Index (CCSI)

Published January 3, 2020

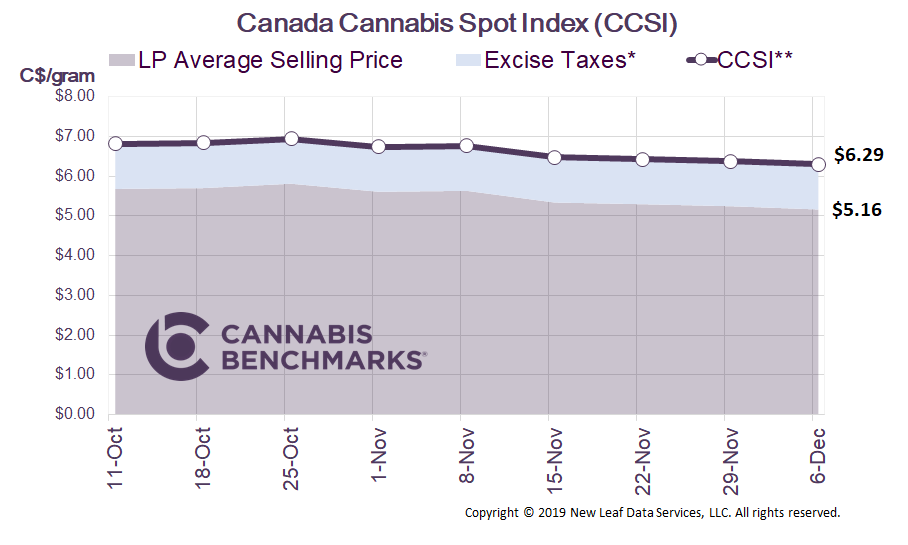

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.61 per gram this week, down 2.1% from last week’s C$6.76 per gram. This week’s price equates to US$2,305 per pound at the current exchange rate.

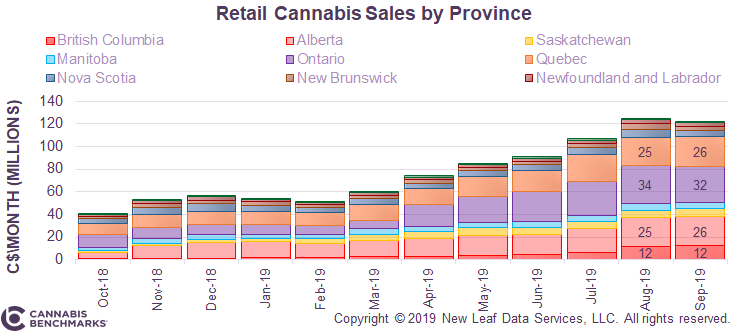

This week we examine the latest Statistics Canada data on retail cannabis sales by province. The release of data for October 2019 now gives us a view of sales expansion in each province over the course of the first year of Canada’s legal adult-use market. Total retail sales for October 2019 amounted to C$129M, or C$4.2M per day.

As seen in the chart below, retail sales grew steadily until August, after which they leveled off. The variances in average daily sales from August through October were within C$100,000 of an average of C$4.1M per day.

Source: Cannabis Benchmarks

Total national sales grew 240% from last November, but drilling into individual provinces tells quite a different story. Most provinces do show a big jump, but Manitoba saw almost no growth, while the Maritime Provinces actually saw a decline in monthly revenue.

Source: Cannabis Benchmarks

Notable aspects of the data include:

- Both Manitoba and the Maritime Provinces showed no growth over the year, even though the number of licensed stores grew and product prices dropped.

- British Columbia’s sales grew by 1,201%. This is not entirely surprising; sizeable illicit market sales shifted to the legal side, as the number of licensed storefronts grew from less than 10 to over 100 in that time frame.

- Ontario – the largest province by population – experienced significant sales growth, but the most recent revenue figures are quite comparable to those of provinces such as Alberta, which has a much smaller population. 2020 should see Ontario’s sales break away from those of other, less populated provinces, as more stores open due to the Ontario government relaxing their retail store licensing process.

- Alberta has the most storefronts of all the provinces and this shows in the sales figures. Alberta sales grew by 253%, while the number of storefronts expanded by 580%.

- Saskatchewan sales were robust with a growth rate of 315% over the year. This is the only province where licensed producers can sell directly to retail stores, essentially cutting out the middle man (the Canadian government in this case). This keeps prices lower and more competitive with the black market.

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.