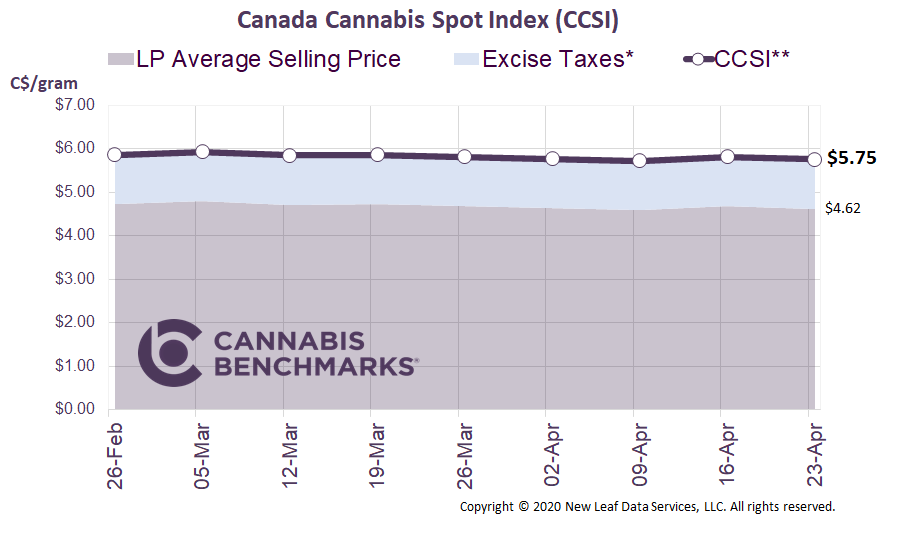

Canada Cannabis Spot Index (CCSI)

Week Ending February 26, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.86 per gram this week, up 1.5% from last week’s C$5.77 per gram. This week’s price equates to US$2,107 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

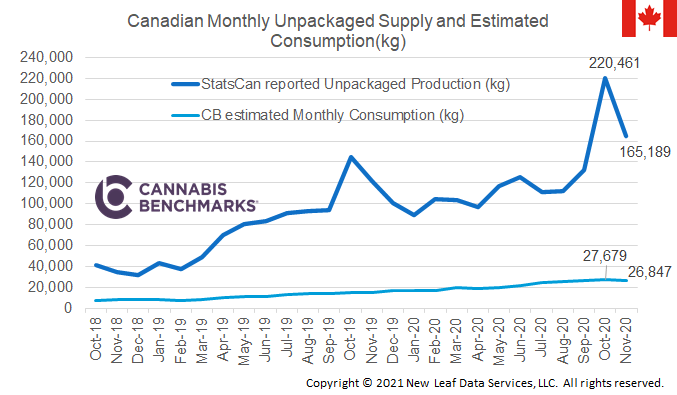

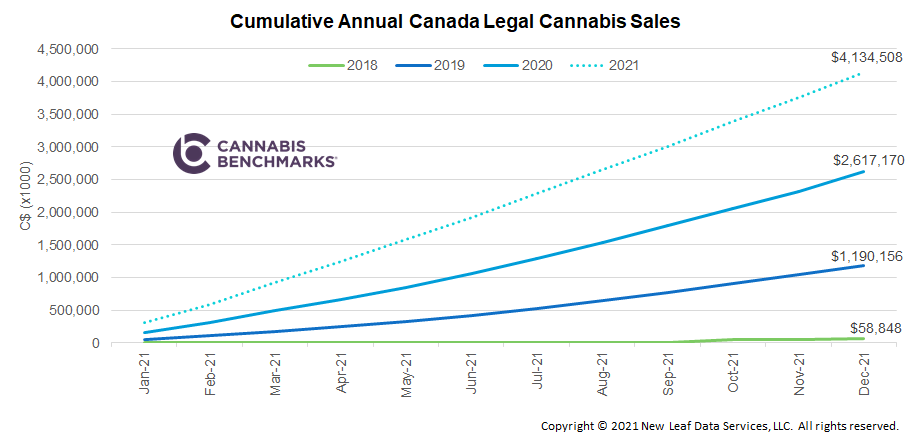

Last week, Statistics Canada released retail sales data for December 2020. December sales reached C$298.4M, up C$37.4M from November. On a monthly basis, sales have been increasing steadily across Canada; with the latest data point we now have a complete look at 2020. Total 2020 legal cannabis sales amounted to C$2.6B, which is C$1.43B or 120% higher than 2019’s revenue tally.

Source: Cannabis Benchmarks

The country’s legal cannabis market looks to be on the right trajectory, as sales have increased almost every month since they began. Nationwide, the number of stores increased by 701 in 2020, to 1,369 by the end of the year, despite some delays in approving and opening new businesses associated with COVID-19.

In the larger provinces, better accessibility to the regulated market has equated to higher sales. December’s numbers show a bump in daily sales across all the major provinces. Ontario’s sales continued to expand at an exponential rate, while revenues in the other three major provinces maintained their linear growth rate.

Source: Cannabis Benchmarks

In Ontario, we saw the largest expansion of stores last year, as the licensing process was simplified and streamlined. The number of stores increased from 26 to 288, a trend that certainly contributed to December sales exceeding C$3M per day in Ontario. We expect that number to grow to C$4.8M per day by the end of 2021.

With this additional data for the last quarter of 2020, we revised our 2021 forecast higher this week. At the December 2020 run rate, sales would exceed C$3.5B in 2021. But with the continued expansion in store counts, increased product variety as cannabis 2.0 products develop and diversify, and additional customers as legal channels become more price competitive with illicit sellers, we are now forecasting that the legal market will exceed C$4.1B this year.

Source: Cannabis Benchmarks

In the upcoming Nasdaq Cannabis Market Insights report, we will break out our 2021 projections for the major provinces. Click the link below to subscribe.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.