Canada Cannabis Spot Index (CCSI)

Published December 25, 2020

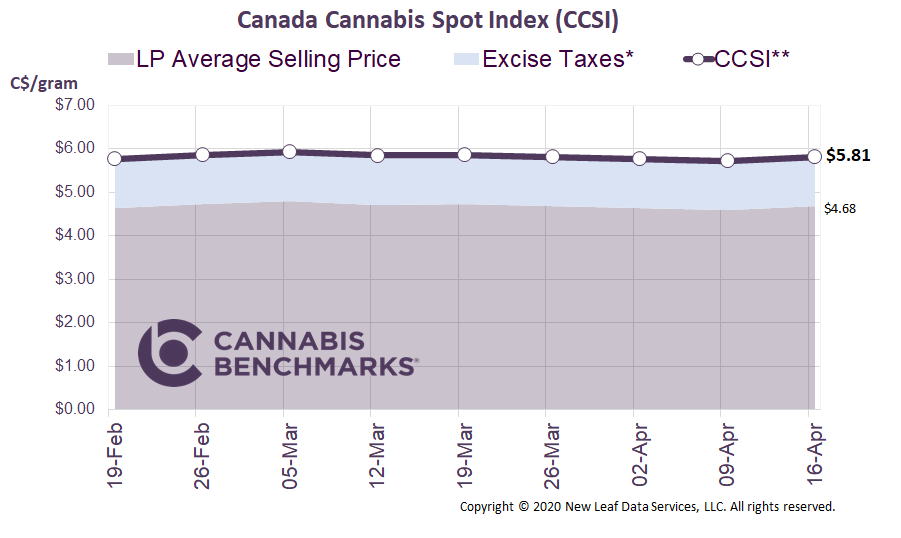

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.05 per gram this week, down 2.4% from last week’s C$6.20 per gram. This week’s price equates to US$2,140 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week the Ontario Cannabis Store (OCS), the body that regulates the province’s cannabis market, released their Q2 Cannabis Insights reportfor the period from July through September 2020. The report contains a wide variety of useful data to show how Ontario’s market is developing. In today’s report, we focus specifically on price.

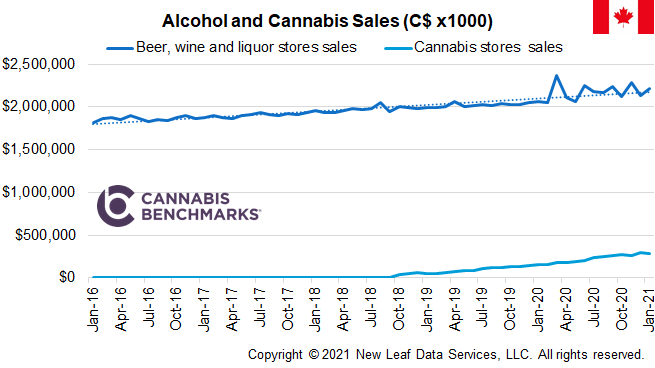

The legal Canadian cannabis market has faced strong competition from illicit supply chains, due to high product prices and few stores. The OCS’s latest report shows those market dynamics are changing.

The report shows that not only did the brick and mortar retail footprint grow to 178 stores from 100, but the price of dried flower on the OCS online store dropped by 9%, falling further below the price of cannabis sold through illegal mail-order marijuana (MoM) sites after doing so in Q1 for the first time. The average price of legal dried flower, including sales taxes, was C$6.41/gram. The reduction was largely a result of discount lines of cannabis released by the big Licensed Producers. In comparison, the average dried flower price on illegal MoM sites rose by C$0.19 to C$7.98/gram. While the quality of the dried flower was not taken into consideration for this price comparison, legal product has some overall advantages in this regard due to required quality assurance and safety testing, prohibitions on pesticide use, and standards for accuracy in labeling, among other regulations.

Source: OCS

Clearly, lower prices have helped legal sellers build market share. The report indicates 36.2% of cannabis sales are now being made through legal channels. We believe that, along with lower prices, COVID lockdowns have pushed consumers to more regulated and inspected products.

Overall, this report once again emphasizes that positive trends for the legal cannabis industry are emerging and being cemented as the regulated market develops.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.