Canada Cannabis Spot Index (CCSI)

Published December 11, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.09 per gram this week, up 0.9% from last week’s C$6.04 per gram. This week’s price equates to US$2,155 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

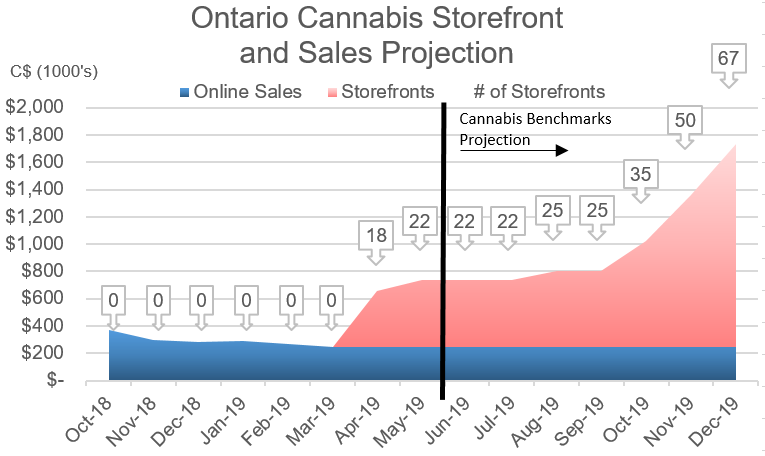

This week we revisit our outlook for the growth of cannabis store counts and sales in Ontario. The province’s Alcohol and Gaming Commission (AGCO) issued a statement on December 8 regarding Cannabis Retail Store Authorizations, which necessitates updates to our projections.

Last December, after pressure from the cannabis industry, the Ontario government altered its retail store licensing process from a lottery system to a more open format. The goal was to issue up to 20 retail store licenses each month starting in April. Then, in a statement in September, AGCO stated they would “double the pace of store authorizations this fall.” This suggested an average of 40 new stores each month through the end of the year. Despite the province missing its targeted increase in October and November, this week’s statement ups their growth estimate once again.

Starting this month, Ontario’s cannabis store regulator is now set to double the number of Retail Store Authorizations (RSA) it is issuing each month to 80. This is a massive increase, and a necessary shock to boost legal cannabis sales in Canada’s most populous province.

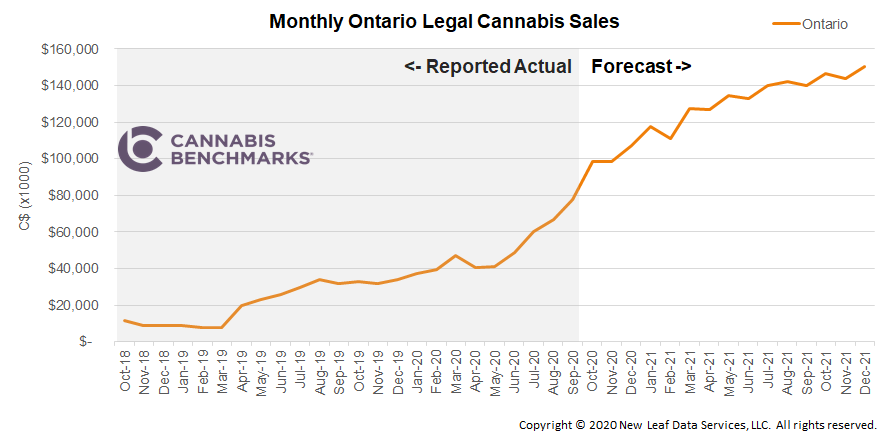

With the new RSA target, we anticipate 80 stores to open on average each month throughout 2021. At this rate, the current 240 stores would increase to roughly 1,260 stores by the end of next year.

Source: Cannabis Benchmarks

As we stated last week, based on the current store count of 240, each store serves roughly 60,000 Ontarians. (This number is not adjusted for underage people or those that choose not to consume cannabis products.) If the forecast of 1,260 stores is achieved, there will be one retailer per 11,500 Ontario residents. This number is closer to Alberta’s per capita store count, as well as those of some mature state markets in the U.S.

Over the past two years, we have reported on the very strong relationship between the number of open stores and monthly retail sales in each province. Each new store provides better accessibility to the legal cannabis system and helps pull consumers away from the still-robust illicit market. The latest sales data for September 2020 issued by Statistics Canada shows Ontario cannabis retail sales totaled C$77.9M that month with 178 stores open. Based on the new RSA target of 80 new stores per month, our updated forecast shows sales growing dramatically over the course of 2021. We now project Ontario’s total sales to exceed C$1.6B by the end of next year.

Source: Cannabis Benchmarks

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.