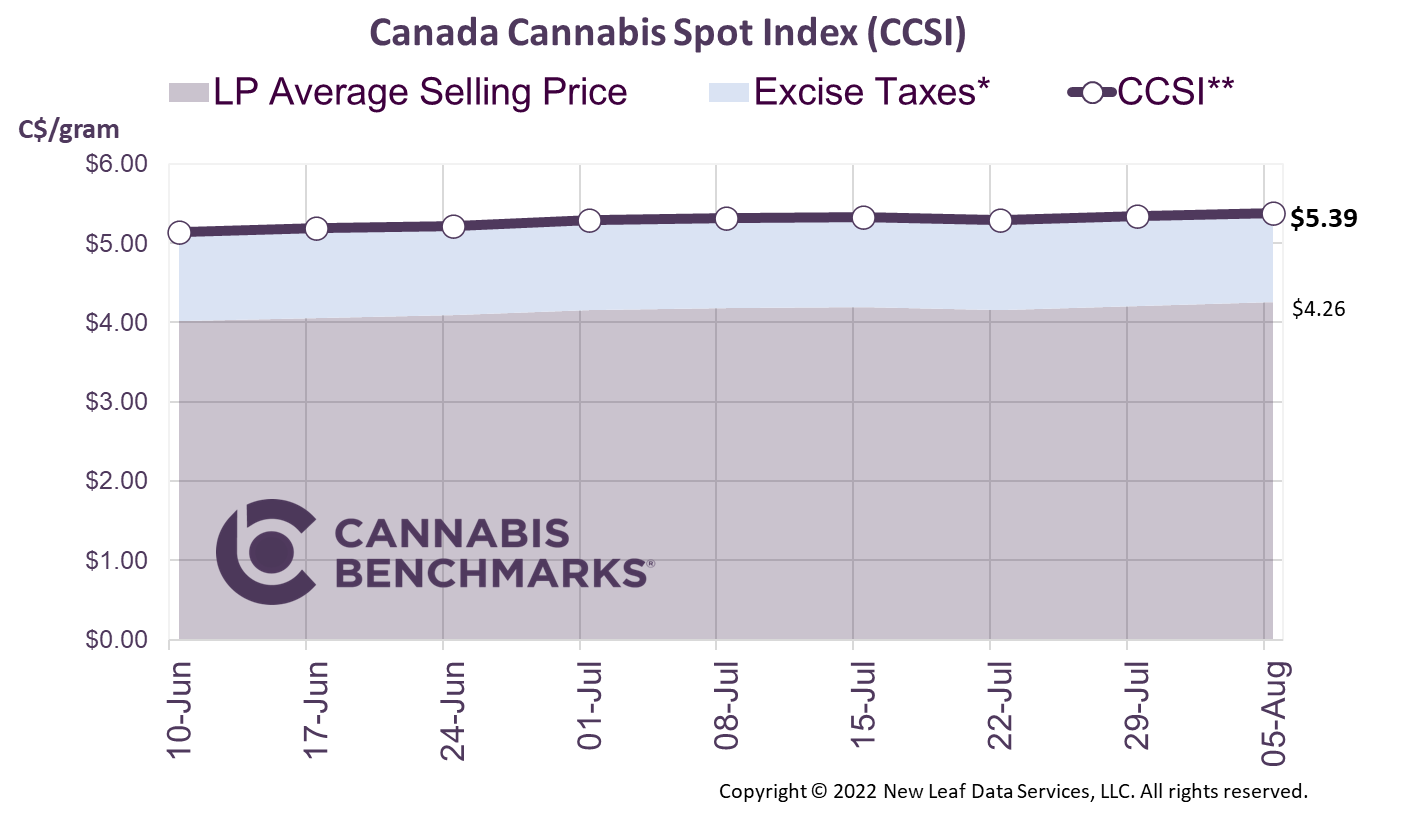

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.39 per gram this week, up 0.8% from last week’s C$5.34 per gram. This week’s price equates to US$1,898 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

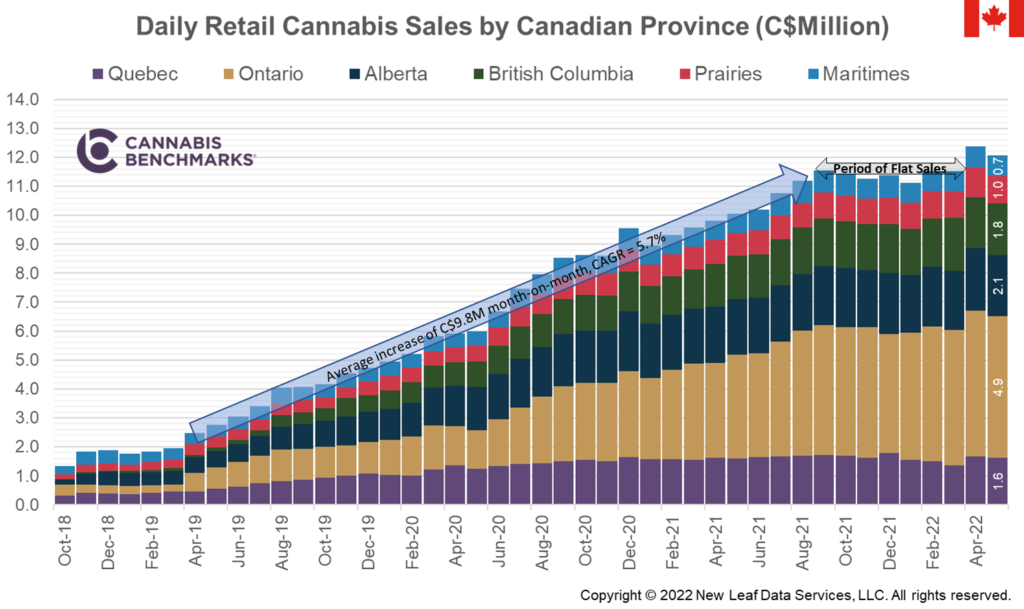

- Statistics Canada recently released May retail cannabis sales for the country. Sales increased from April by C$2.5M to C$375.8M. To correct for the different number of days per month, we look at the data in terms of average daily sales in the above chart. The latest data shows average daily sales fell to C$12.1M in May, a decrease of 2.6% from April when a record-high figure was established.

- However, this is the second month we have seen sales hold above the stagnant daily revenues observed from August 2021 through March 2022. In that period, sales were stuck between C$11.2M to C$11.6M per day, all while store counts increased and production variety grew. This raised concerns for the industry by suggesting that sales were reaching a saturation point or average sales prices were falling while sales volumes grew.

- In May, sales dropped across all provinces from the previous month, with the exception of British Columbia, where sales grew slightly – by 0.5% month-on-month – to C$1.77M per day. All other major provinces saw sales drop by 2.3% – 2.8%.

- If sales continue at the daily run rate for May, we should exceed C$4.36B in sales for 2022. (That calculation assumes daily sales average of C$12.1M between June and December.) This should paint the low-end expectation for sales this year, as the May figures precede the summer season, which generally sees higher seasonal sales, along with the end-of-year holiday period. Additionally, we continue to see growth in store counts and more online / delivery options, which should continue to pressure the illicit market’s share of total cannabis sales in the country.