Photo: Aaron Burden/Unsplash

Photo: Aaron Burden/Unsplash

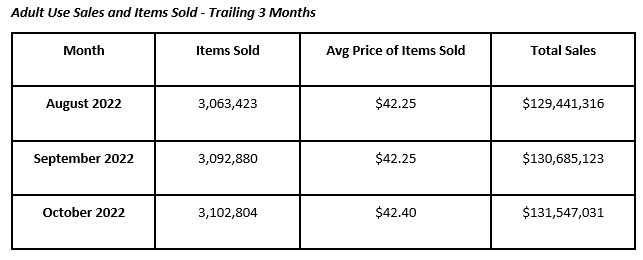

The Illinois Department of Financial and Professional Regulation (IDFPR) issued October 2022 adult use sales figures this week. October combined sales to in-state and out-of-state customers, at $131.5 million, were up 0.7% from September 2022 combined sales of $130.7 million and up 6.6% from September 2021 sales of $123.4 million.

October 2022 adult use sales to in-state residents, at $90.9 million, rose 1.5% from September 2022 in-state sales of $89.5 million and are up 11.9% from $81.2 million in October 2021. October 2022 sales were 69% of total monthly sales, up from 68.5% of total sales in September 2022 and up from 65.8% of total sales in October 2021.

October out-of-state sales, at $40.7 million, were down 1.3% from September 2022 sales of $41.2 million and are down 3.6% from October 2021 sales of $42.2 million. October 2022 out-of-state sales were 31% of total sales, down from 34.1% of total sales in October 2021.

IDFPR supplies monthly data on the number of items sold: October 2022 items sold at 3.1 million, was up 0.3% from 3 million items sold in September 2022 and up 12.5% from 2.8 million items sold in October 2021.

The average price of items sold in October 2022 rose $0.15 month-on-month to $42.40 per item but is down $2.34 from October 2021’s average per item cost of $44.74.

The Illinois Department of Public Health (IDPH), which oversees the state’s medical cannabis program, issued updates on patient numbers and sales figures for September and October 2022. September 2022 medical sales were $28 million, down 3.1% from August 2022 sales of $29 million and down 14% from September 2021 sales of $32.6 million.

In September 2022, IDPH reported 239,294 qualifying patients since the program began in September 2014, a 1.4% increase over qualifying patients as of August 2022 and up 43.8% from 166,356 qualifying patients recorded in September 2022.

September 2022 flower sales in the medical cannabis program were $13 million, up 0.3% from August sales of $12.9 million, but down 14.9% from September 2021 medical sales of $15.3 million.

In September 2022, 63,667 unique patients purchased an average of 17.6 grams of dried flower, up 0.3 grams from 17.3 grams purchased in August 2022. Medical cannabis flower sold at an average price of $11.60 per gram, down $0.15 from the August 2022 price per gram and down 18.7% from $13.77 in September 2021.

In October 2022, IDPH reported 244,690 qualifying patients in the medical cannabis program, up 2.3% from September 2022 and up 42% from October 2021’s qualifying patient count of 172,362.

October 2022 flower sales in the medical cannabis program were $13 million, down marginally from September flower sales and down 15.5% from sales of $15.4 million in October 2021.

In October 2022, 63,945 unique patients purchased an average of 17.6 grams of flower, virtually unchanged from the September 2022 average purchase. Medical cannabis flower sold at an average price of $11.51 per gram, down $0.09 per gram from September 2022 and down 14.2% from an average price of $13.41 per gram in October 2021.

Illinois retains the highest cannabis prices in the nation for reasons well-covered here, but that does not mean the state’s cannabis prices are invulnerable. In fact, a recent four-month rally has reversed, with average monthly prices taking a turn lower in September and October 2022. Spot cannabis prices are still holding the $3,500 per pound handle; technically, the best-case scenario is for price to move sideways, but the more likely move is lower, perhaps to test recent lows in the mid $3,300s.

While in-state competition is severely limited, the fact remains cannabis just one state away in Michigan is trading at less than one-third the cost of Illinois spot. West Coast prices are just 20% of Illinois spot price. So, while high risk, there are those that think arbitrage at these metrics is worth the reward. Moreover, the quality differential from West Coast to Illinois is pronounced according to multiple sources and there is demand in Illinois for high quality cannabis – as there is in every market. Illinois prices will eventually erode, but for now they are in a sweet spot for the state’s cannabis industry.